Meet the Founder

- Home

- Meet the Founder

Meet the Founder

Why I Built MoneyMate

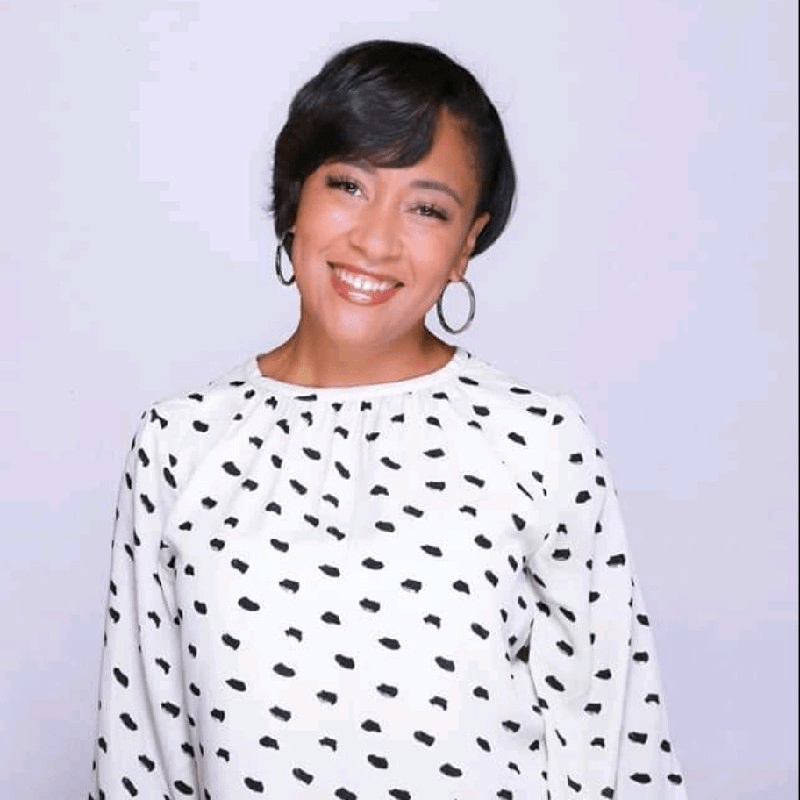

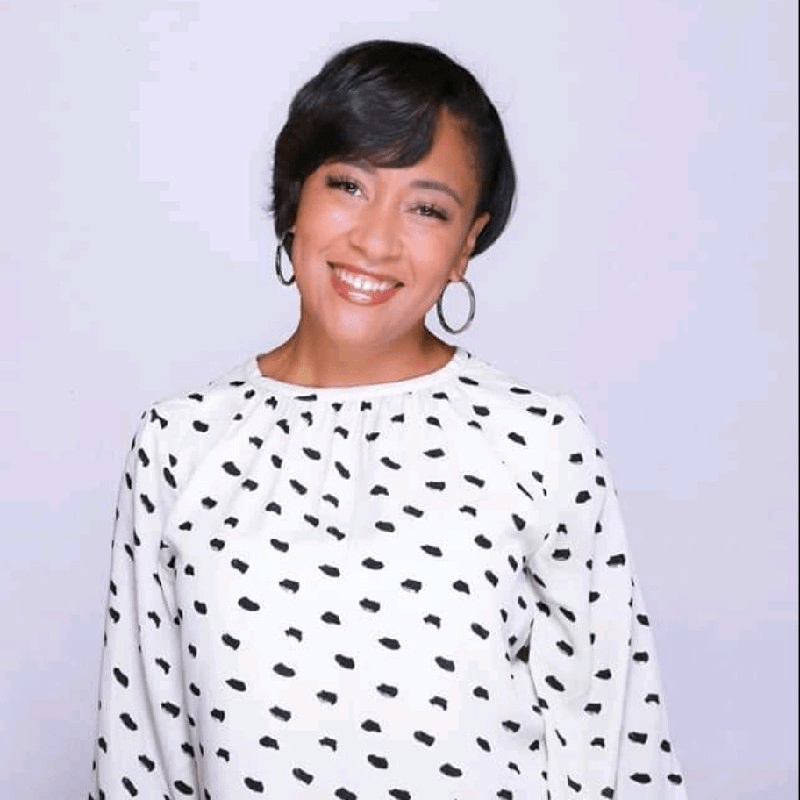

Hi! I’m Elena Colquitt, founder and CEO of MoneyMate—and I’m thrilled you’re here.

After more than 17 years in finance—through trust services, retail banking, home loan origination, and consulting for individuals and small businesses—I realized something important: most people don’t need another expense tracker. They need a strategy. They need tools that help them plan ahead, not just log what’s already happened.

One thing I saw again and again: people weren’t failing because they were “bad with money”—they were failing because they didn’t have a plan. They lacked the behaviors, habits, and systems that make money manageable. And without those, even smart, capable people kept getting caught off guard.

That’s why I built MoneyMate—a FinTech platform that helps people forecast their cash flow, align spending with income, and finally stop living reactively. It’s the first tool designed to unify personal and business finances in one dashboard—with a clear look ahead.

My Story: From Experience to Empowerment

My journey started in 2007 with a Business Administration degree focused on Finance from Florida A&M University—and a deep desire to help others feel confident with money. I entered the industry during the financial crisis, witnessing firsthand how poorly most systems served everyday people.

As I built my career—and later launched a consulting firm in Atlanta—I kept hearing the same frustrations: “No one taught me this,” and “I’m always behind.”

So, I created something different: a system for proactive, personalized financial planning. That system earned a U.S. patent in 2019, and became the foundation for MoneyMate—launched in 2023 to help individuals and small business owners plan forward with confidence.

Author of The Money Manual

I also wrote The Money Manual: What They Should’ve Taught Us About Money but Didn’t—a practical, jargon-free guide covering 26 essential financial topics. Whether you’re just starting out or rebuilding your relationship with money, this book helps make smart financial decisions feel clear and possible.

What Sets Me Apart

- Human First– I lead with empathy, not spreadsheets—because money is emotional.

- Experience-Driven– My background spans trust services, home lending, banking, and personal financial consulting.

- Purpose-Driven– As a certified DBE/SBE/MBE business, I’m committed to making financial empowerment accessible for all.

Core Values I Bring to MoneyMate

- Resilience & Adaptability– Turning complex money challenges into clear, simple strategies

- Consistency & Discipline– Showing up with tools that work in real life

- Forward Thinking – Helping you act before money becomes a problem

My Mission for You

- End the paycheck-to-paycheck cycle, helping to build generational wealth

- Break the habit of reacting to financial stress

- Align your income with your values—so money becomes a tool for freedom, not frustration

Let’s Connect

Have a question, partnership idea, or want to talk strategy?

Or explore how MoneyMate can help you plan forward.